Summary

Worldwide nuclear risk levels in June 2025 are elevated across several dimensions. Multiple reactors are in or coming out of outages for refueling, maintenance, or unexpected trips, straining generation capacity and reliability. A handful of safety incidents – including coolant leaks and human-factor errors – have occurred, though with no offsite radiological impact. Nuclear weapons-related facilities maintain a heightened security posture amid ongoing audits, insider-threat drills, and occasional protestsnukeresister.org. Construction of new reactors and fuel-cycle projects continues to face delays from technical hurdles and supply chain issues. Geopolitical conflicts further exacerbate risks: the Ukraine war is directly endangering nuclear sites through shelling and drone strikes, and sanctions are disrupting nuclear fuel supply chains. The following analysis details these risk categories and provides region-by-region outlooks for the rest of June 2025.

Risk Summary

Reactor Outage Risk (R-Scale)

Indices & Timing: Numerous nuclear units are in planned outages for refueling or life-extension work this month alongside a few unplanned shutdowns. For example, Belgium’s Tihange 3 (1,038 MW) is on an extended maintenance outage from early April until early July as part of life-extension preparations. In Finland, the new Olkiluoto 3 (1,600 MW) reactor experienced a sudden turbine trip last year (June 3, 2024) that removed its full output from the grid without notice. Such incidents continue to occur infrequently but with significant impact. Grid operators have also managed unplanned reactor trips in recent months (e.g. a manual scram of Vogtle 1 in the U.S. on May 28, 2025 due to a feedwater pump failure). Heading into mid-2025, roughly the usual number of reactors are offline for scheduled refueling, but some outages have stretched longer than planned – Olkiluoto 3’s spring maintenance doubled from 37 to 74 days due to defect repairs – heightening supply risk.

Hazards: The primary hazard is generation shortfall. Extended or unexpected reactor outages can drop output by 1+ GW in an instant, risking grid frequency dips and instability. Prolonged outages stress reserve margins and may force greater reliance on fossil-fired generation. Unplanned automatic shutdowns (scrams) can also incur thermal stresses on reactor systems. If multiple units are down concurrently (whether for refueling or due to scrams), regions can face tight electricity supply, spiking prices, and potential capacity shortfalls especially during peak summer demand.

Level: High. Global outage risk is high in June 2025 given the confluence of planned maintenance season and notable unplanned events. While operators schedule refueling to minimize overlap with peak demand, several reactors (including large new units) being offline or at reduced power elevates the risk level. Even a single major unit trip has shown outsized effects on regional grids.

Impacts: The impacts include challenges to grid stability – for instance, the sudden loss of Olkiluoto 3 last year caused Nordic grid frequency to plunge to ~49.5 Hz, requiring rapid balancing response. Outage-driven supply gaps tend to increase wholesale power prices and volatility. Countries may need to lean on emergency reserves or imported power. In some cases, governments prolong coal/oil plant operation or delay reactor retirements to counteract nuclear outages. Overall, a high R-Scale risk implies pressure on electricity systems, potential brownout conditions in worst cases, and setbacks to carbon emissions targets as more fossil backup is burnt to fill nuclear generation gaps.

Safety Incident Risk (S-Scale)

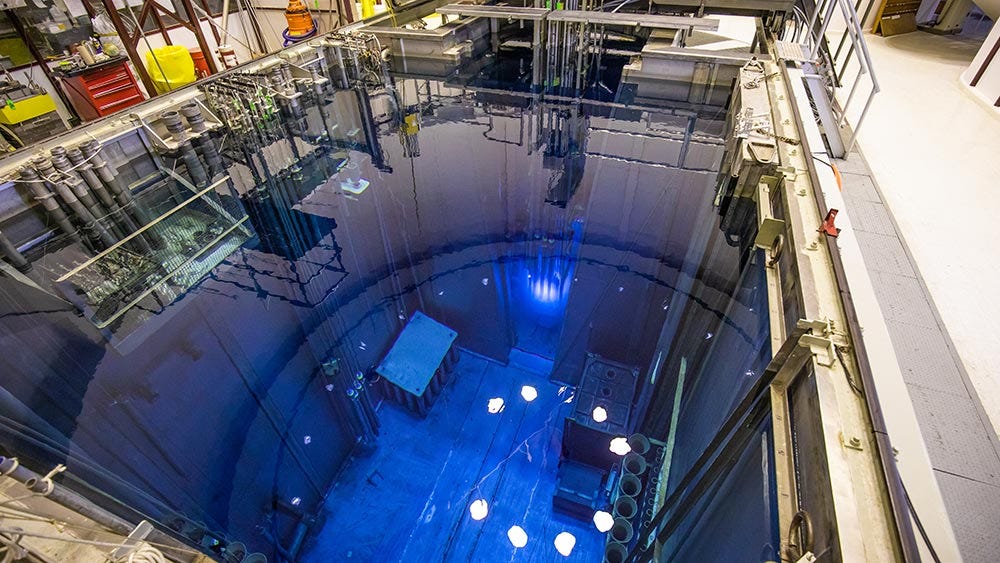

Indices & Timing: Recent months have seen a moderate number of safety-related events, though mostly of low severity. Notable incidents include a radioactive coolant leak at Finland’s Olkiluoto 3 in March 2025, when ~100 m³ of reactor coolant spilled inside containment during maintenance. The leak was traced to human error – an open pool hatch – and was contained without environmental release. Elsewhere, there have been a few scrams triggered by operator or maintenance errors (e.g. a U.S. reactor was manually tripped in May after maintenance on a feed pump went awry). Overall, industry data show human performance issues remain a leading cause of unplanned plant transients. Thus far in June 2025 no major reportable accidents have occurred, but minor safety events (sensor faults, small leaks, etc.) are being logged by regulators at a typical frequency.

Hazards: The hazards under S-Scale include equipment failures (pumps, valves, electrical systems) and human or procedural lapses that can lead to reactor trips, leaks of radioactive fluids, or other anomalies. Any coolant leak – even one fully contained – heightens concern about maintenance rigor. Unplanned SCRAMs stress reactor components and can shorten maintenance intervals. Recurrent minor safety issues also hint at underlying procedural shortfalls. While none of the recent incidents posed public danger, each triggers investigations and corrective actions. A latent hazard is that a combination of errors under unfavorable conditions could escalate into a more serious event.

Level: Moderate. Safety incident risk is moderate at present. The nuclear industry’s defensive layers have so far prevented minor events from escalating. However, the occurrence of multiple low-level incidents (leaks, automatic trips) across different countries suggests room for improvement in safety margins. Regulators are on alert, but not to the degree of any imminent crisis.

Impacts: Even minor safety incidents carry consequences. Unplanned downtime for inspections and repairs can reduce plant availability and revenue. Repeated events invite stricter regulatory scrutiny – for instance, plant operators may be required to implement new training or retrofit equipment, incurring costs and potentially causing further outages. Public confidence can be eroded by news of leaks or errors, even if contained. In the worst case, a string of mishaps could delay license renewals or derail plans for new reactors. Thus, a moderate S-Scale risk level warrants vigilance: nuclear operators must redouble safety culture efforts to avoid a serious incident that could have broader implications for the industry.

Weapons Facility Security Risk (W-Scale)

Indices & Timing: Nuclear weapons-related sites worldwide are under heightened security monitoring in mid-2025. Recent security audits have prompted improvements at key facilities. In the UK, the Office for Nuclear Regulation issued an improvement notice to AWE Aldermaston after a 2024 incident in which workers mishandled an explosive component due to procedural failures. While that was a safety lapse, it raised questions about work control and oversight at a high-security warhead site. In the U.S., internal reviews at the Pantex Plant (the nuclear weapons assembly facility in Texas) have highlighted technical compliance issues – for example, in May 2025 Pantex engineers discovered a violation of a Technical Safety Requirement, leading to a stop-work order until equipment settings were correcteddnfsb.govdnfsb.gov. Insider-threat preparedness is a major focus: the U.S. NNSA and international partners convened an Insider Threat Mitigation symposium this spring, underscoring the global concern in this arena. Additionally, activist groups continue to target weapons sites with protests – notably, ten protesters were arrested in April 2024 after trespassing at the NNSA’s Kansas City weapons-parts campus during a demonstration against nuclear weapons productionnukeresister.orgnukeresister.org.

Hazards: Key hazards include espionage attempts, sabotage or theft of nuclear materials, insider collusion, and disruptions from protest actions. Nuclear weapons facilities are prime targets for hostile intelligence services; the insider threat programs address the risk of employees being co-opted or disgruntled. Sabotage or terrorist attacks, while highly unlikely given heavy security, are the worst-case hazard – a successful sabotage at a warhead plant or fissile material storage could have catastrophic consequences. Even non-violent incursions by activists test the physical security perimeter and response protocols. Cybersecurity is another dimension of W-Scale risk: state-backed hackers and hacktivists are probing nuclear enterprise networks, which could potentially compromise sensitive information or facility operations.

Level: Moderate. Security risk at weapons-related facilities is being managed rigorously, but remains moderate. There are no verified breaches or imminent threats as of June 2025, yet the constant vigilance required and recent findings of procedural gaps keep the risk above low. Given global tensions, agencies are treating the threat environment as elevated – for instance, the UK and U.S. have both allocated additional resources to bolster security personnel and insider vetting this quarter.

Impacts: A moderate W-Scale risk level means continued high security posture: guard forces on alert, frequent drills, and possibly slower operations due to security protocols. At sites like AWE Aldermaston and Pantex, ongoing audits or enforcement actions may delay certain activities (e.g. temporarily pausing operations for safety or security upgrades). Heightened security can also strain budgets and schedules – maintenance and construction at these sites often must proceed under tight oversight, which can introduce inefficiencies. On the strategic level, any credible security incident could undermine confidence in the nuclear deterrent and fuel political controversy. Thus, while no major security breach has occurred, the sustained moderate risk necessitates proactive measures to prevent even minor incidents.

Construction & Delay Risk (C-Scale)

Indices & Timing: Numerous nuclear construction and modernization projects are encountering delays or cost growth in 2025. Large Gen III+ reactors (EPRs) have notorious schedule problems: France’s Flamanville 3 EPR, begun in 2007, is now 12 years behind schedule with costs quadrupled to ~€13.2 billion. In the UK, Hinkley Point C’s two EPR units, originally due 2025, have been pushed to 2029 for first operation, with cost estimates swelling to £31–34 billion. Even advanced small modular reactors are facing delays – the Bill Gates-backed Natrium SMR project in Wyoming announced a minimum 2-year delay (to ~2030) because its specialized fuel (HALEU) is no longer available from Russia. In the fuel cycle sector, Japan’s Rokkasho Reprocessing Plant has again extended its timeline: now slated to finish in FY2026, marking the 27th delay for this project since 1993. These examples typify the C-Scale index: many projects large and small are missing milestones in 2025.

Hazards: The hazards underpinning these delays include engineering challenges, regulatory/licensing hurdles, supply chain bottlenecks, and financing difficulties. New reactor designs often encounter technical mismatches between plans and reality – for instance, Flamanville’s construction required numerous reworks to meet safety standards, and Hinkley’s project had to use far more steel and welding than anticipated. Supply chain and geopolitical issues also bite: the Natrium SMR’s delay is directly due to losing access to Russian-supplied high-enriched fuel. Additionally, cost overruns can prompt investors or governments to pause or slow funding, further delaying progress. Each delay in one project can have ripple effects, eroding public and political support for other planned projects.

Level: High. Construction and delay risk is high globally this month. Several flagship projects are significantly behind schedule, and there is growing recognition that nuclear build timelines in general are stretching longer than planned. With inflation and supply chain uncertainties still factors in 2025, even projects previously thought to be on track (such as newer SMR initiatives) are encountering new obstacles. High C-Scale risk reflects the strong likelihood of delays in existing projects and skepticism around start dates for proposed reactors.

Impacts: The impacts of high C-Scale risk are substantial. Slower nuclear capacity growth means missed targets for decarbonization in energy systems counting on new reactors to replace fossil generation. For utilities and vendors, delays translate to budget overruns and the need for bridge financing or government bailouts (as seen with France’s backing of Areva for Olkiluoto 3’s overruns). Investor confidence can be shaken, making it harder to secure funding for future nuclear ventures – a vicious cycle of delay leading to diminished capital for the sector. At the grid level, delayed projects like Hinkley Point C or Rokkasho force countries to adjust contingency plans (e.g. life-extensions of older reactors, reliance on imports or alternative energy sources). In sum, a high delay risk jeopardizes the anticipated nuclear resurgence in some regions and could impede climate objectives unless mitigated by policy support and improved project management.

Geopolitical Risk (G-Scale)

Indices & Timing: Geopolitical conflicts and tensions are casting a long shadow over nuclear safety and operations in June 2025. Foremost is the ongoing war in Ukraine, which directly threatens nuclear facilities. The Russian-occupied Zaporizhzhia Nuclear Power Plant (ZNPP) has been the scene of repeated military incidents – in April, drones struck the site, with explosions observed near reactor units. Each side has accused the other of shelling near the plant, violating agreed safety principles. IAEA reports from late April warn the situation at ZNPP is worsening, with bursts of gunfire and detonations heard almost daily around the site. Ukraine’s energy minister recently said Russian missile attacks on the country’s remaining operational plants (Rivne, South Ukraine, Khmelnitsky) have left them “one step away from nuclear meltdown” at times, as strikes on grid substations force emergency shutdowns and reliance on backup generators. Moreover, a drone strike on Feb 14 damaged the New Safe Confinement at Chernobyl, punching a hole in the structure enclosing the ruined reactor and igniting fires that burned for weeks. Beyond Ukraine, geopolitical tensions are impacting nuclear commerce: in a standoff over sanctions, Russia has even sought IAEA mediation regarding U.S.-supplied nuclear fuel at ZNPP. Western nations are moving to curtail Russia’s nuclear exports (a bipartisan U.S. proposal would slap 500% tariffs on any country importing Russian uranium), potentially disrupting fuel supply for reactors in Eastern Europe and elsewhere.

Hazards: The most acute hazards are physical destruction or power loss at nuclear sites due to warfare. Shelling or missile strikes could disable critical safety systems or spent fuel cooling, potentially leading to radiological releases. A direct hit on an operating reactor is the nightmare scenario (even though all ZNPP reactors are shut down, the pools and fuel still need cooling). The February attack on Chernobyl’s containment underscores that even decommissioned facilities are not off-limits, raising the specter of radioactive contamination if the confinement or waste stores were further damaged. Geopolitically driven supply disruptions form a slower-burning hazard: if nuclear fuel deliveries are halted by sanctions or conflict, plants could face operational hurdles or forced outages once current fuel loads are spent. In addition, rising international tensions increase the risk of cyber-attacks against nuclear infrastructure and heighten the threat environment for nuclear materials transport. Finally, there’s the hazard of nuclear rhetoric and brinksmanship – for instance, if deterrence postures are mismanaged, it could complicate the security of weapons facilities.

Level: High. Geopolitical nuclear risk stands at high in June 2025. The combination of an active war involving nuclear power plants and fracturing international cooperation on nuclear trade (due to Russia-West sanctions) makes this an extraordinarily fraught period. IAEA warnings about Ukraine – drones actually striking a nuclear plant – represent an unprecedented situation in the nuclear era. Neighboring countries are on edge, with emergency response plans and iodine tablets prepared in case of an incident at ZNPP. The high G-Scale level reflects not only the immediate conflict threats but also the broader environment of geopolitical rivalry that could indirectly impact nuclear safety (e.g. reduced communication between nuclear states, or diversion of security attention).

Impacts: A high geopolitical risk exerts wide-ranging impacts. In Ukraine and parts of Europe, nuclear emergency preparedness has been elevated to Cold War-level seriousness – the grid operators factor in the possibility of losing multiple reactors during attacks, and international teams (IAEA) are stationed in war zones to monitor safety. Energy markets also feel the impact: uncertainty around ZNPP and the security of other plants influences electricity pricing and cross-border flows. On the fuel side, efforts to replace Russian uranium supply (which previously accounted for a large share of the world market) could lead to interim fuel shortages or higher costs for reactor operators. Politically, nuclear projects that involve Russian technology (e.g. new builds in some countries) face delays or cancellations under sanctions pressure. In summary, the high G-Scale risk is straining the nuclear sector’s stability – resources are being directed to crisis management and contingency planning, and the margin for error is greatly reduced until geopolitical tensions ease.

Region-Specific Outlooks

North America

Plant Vogtle, USA (EDT)

Timing: 2025-06-01 0000 EDT – 2025-06-30 2359 EDT

Threats:

R-Scale Level: Moderate. The units are operational but recent unplanned downtime and the fact that Unit 3 is newly online suggest a moderate risk of short-term generation loss.

S-Scale Level: Low. No significant safety incidents; NRC oversight is strong. The May trip was handled without complications.

W-Scale Level: N/A

C-Scale Level: Low. The Vogtle expansion was delayed but now essentially finished; remaining work is commissioning fine-tuning, so construction risk going forward is minimal.

G-Scale Level: Low. No direct geopolitical threats; however, as with all U.S. plants, a generalized cyber or terrorism threat exists at a baseline low level.

Risk Zone:

Pantex Plant, USA (CDT)

Timing: 2025-06-01 0000 CDT – 2025-06-30 2359 CDT

Threats:

R-Scale Level: N/A

S-Scale Level: Moderate. Complex operations with explosives and nuclear materials entail moderate safety risk; recent procedure failures are being corrected.

W-Scale Level: High. As the primary U.S. nuclear weapons plant, Pantex assumes a high security risk level by default. Security posture is very robust, but the consequence of any breach would be extremely high, hence a high risk designation.

C-Scale Level: Low. No significant delays or construction projects affecting risk.

G-Scale Level: Low. Global conflict scenarios do not directly impact Pantex operations on U.S. soil, aside from raising overall vigilance.

Risk Zone:

Europe

Tihange 3, Belgium (CEST)

Timing: 2025-06-01 0000 CEST – 2025-06-30 2359 CEST

Threats:

R-Scale Level: Moderate. Planned outage reduces immediate operational risk but raises supply risk; unplanned extension of outage would elevate this.

S-Scale Level: Low. Strong safety oversight by Belgian FANC; extensive inspections are underway as part of the upgrade.

W-Scale Level: N/A

C-Scale Level: Moderate. Major project to extend operation by 10 years is underway; execution risk exists, though Engie has experience and is targeting a November restart.

G-Scale Level: Low. Minimal geopolitical risk; some neighboring countries historically expressed concern over Tihange, but that is a political issue, not an acute threat.

Risk Zone:

Olkiluoto 3, Finland (EEST)

Timing: 2025-06-01 0000 EEST – 2025-06-30 2359 EEST

Threats:

R-Scale Level: Moderate. OL3 provides ~14% of Finland’s power; any forced outage has significant impact. Confidence is growing as it operates more consistently, but moderate risk remains until it has a longer track record.

S-Scale Level: Moderate. The radioactive water leak was an internal event taken seriously. No harm resulted, but it underscores that even new reactors aren’t immune to errors. Finnish regulator STUK is closely monitoring OL3.

W-Scale Level: N/A

C-Scale Level: Low. No ongoing construction – OL3’s saga is essentially over, and planned OL4 was cancelled. The main “construction” related risk would be any need for retrofits if issues are found.

G-Scale Level: Low. Finland’s recent NATO accession has Russia rattling sabers, but there have been no direct threats to Finnish nuclear plants. Cyber defenses have been reinforced as a precaution.

Risk Zone:

AWE Aldermaston, UK (BST)

Timing: 2025-06-01 0000 BST – 2025-06-30 2359 BST

Threats:

R-Scale Level: N/A

S-Scale Level: Moderate. Complex operations mean moderate inherent safety risk. Regulators have imposed improvement measures. The site’s recent track record shows issues being caught and corrected, but zero-risk is impossible given the materials.

W-Scale Level: High. By virtue of its national security importance, Aldermaston operates at high security risk level. The threat is mitigated by extensive security measures, but the rating remains high because consequences of any breach would be severe.

C-Scale Level: Moderate. Large-scale construction projects on-site face challenges; any delays could hinder the UK’s future warhead delivery schedule. Thus far construction risk is managed, but not trivial.

G-Scale Level: Low. The facility isn’t directly threatened by war. Internationally, if nuclear arms treaties continue to erode, it could pressure AWE to expand capacity, but that is a long-term strategic impact.

Risk Zone:

Asia-Pacific

Rokkasho Reprocessing Plant, Japan (JST)

Timing: 2025-06-01 0000 JST – 2025-06-30 2359 JST

Threats:

R-Scale Level: N/A

S-Scale Level: Low. Decades of cold-testing have mitigated many safety issues; the plant will be subject to strict oversight when it starts up. Risk to public is very low under normal ops.

W-Scale Level: Moderate. Massive quantities of nuclear material will be on-site. While a civilian facility, it demands security akin to weapons sites. Japan has invested in physical protection and IAEA safeguards, keeping risk moderate.

C-Scale Level: High. By definition, as Rokkasho is still not complete and on its 27th delay, the construction/delay risk is high. Uncertain schedule and potential cost overruns persist.

G-Scale Level: Low. No immediate conflict threat. Internationally, concerns exist but they manifest as diplomatic pressure, not physical threat.

Risk Zone:

Taishan Nuclear Power Plant, China (CST)

Timing: 2025-06-01 0000 CST – 2025-06-30 2359 CST

Threats:

R-Scale Level: Moderate. Performance is good, but the prior fuel issue keeps a moderate rating until more long-term operational experience is gained with EPR technology.

S-Scale Level: Low. Chinese regulators have maintained rigorous oversight; no safety anomalies reported recently. The 2021 cladding issue was managed safely.

W-Scale Level: N/A

C-Scale Level: Low. No ongoing build at Taishan; China’s focus is on other sites for new reactors.

G-Scale Level: Low. Little direct geopolitical risk. The plant is secure and distant from international flashpoints. Cybersecurity risk exists but is an overarching issue for all critical infrastructure in the current climate.

Risk Zone:

Russia

Kursk Nuclear Power Plant, Russia (MSK)

Timing: 2025-06-01 0000 MSK – 2025-06-30 2359 MSK

Threats:

R-Scale Level: Moderate. Stable operations, but older reactors and war-related grid stress keep it moderate.

S-Scale Level: Moderate. No recent safety events, but RBMK design and wartime conditions warrant a moderate stance.

W-Scale Level: N/A

C-Scale Level: Moderate. Construction of new units proceeding, with some risk due to sanctions impacting timelines or equipment sourcing.

G-Scale Level: High. Proximity to conflict raises the specter of a nuclear safety/security incident. Drone incursions in 2024 are a red flag. Russian air defenses are presumably protecting the site, but the war risk is real.

Risk Zone:

Ukraine

Zaporizhzhia Nuclear Power Plant, Ukraine (EEST)

Timing: 2025-06-01 0000 EEST – 2025-06-30 2359 EEST

Threats:

R-Scale Level: Low. No power production; the concept of “outage” is moot since it’s deliberately offline. There is low risk of sudden outage because it’s already off, but risk of forced criticality if someone attempted a rushed startup is present but unlikely.

S-Scale Level: High. Safety incident risk is high given the abnormal conditions: for instance, cooling interruption or damage to the spent fuel storage could lead to radiological release. The plant’s safety systems are being tested like never before.

W-Scale Level: N/A

C-Scale Level: N/A

G-Scale Level: High. Arguably very high – active combat operations around a nuclear plant. Until the military situation resolves, this is one of the most dangerous nuclear scenarios globally.

Risk Zone:

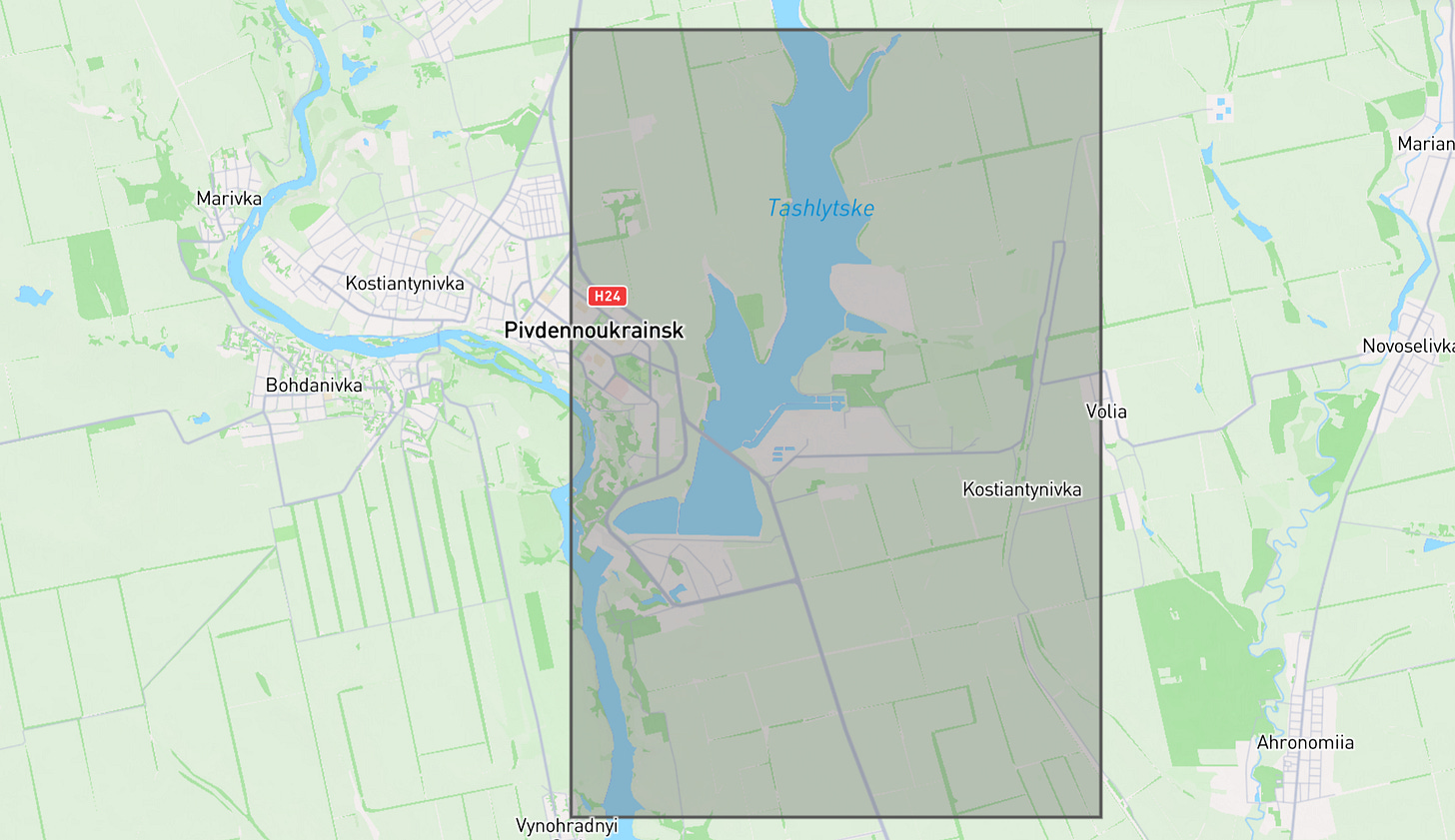

South Ukraine Nuclear Power Plant, Ukraine (EEST)

Timing: 2025-06-01 0000 EEST – 2025-06-30 2359 EEST

Threats:

R-Scale Level: Moderate. The plant is operating but at risk of unplanned outages due to external factors. It provides critical power for Ukraine’s south – any outage complicates Ukraine’s energy balance.

S-Scale Level: High. Not due to internal issues, but because war conditions compromise multiple layers of safety. Operators have managed heroically, but the risk of a forced emergency (like loss of all offsite power) is persistently high.

W-Scale Level: N/A

C-Scale Level: N/A

G-Scale Level: High. In the context of war. Each missile barrage or drone spotted raises this risk. The fact that drones were shot down near the plant in April demonstrates the immediacy of the threat.

Risk Zone: